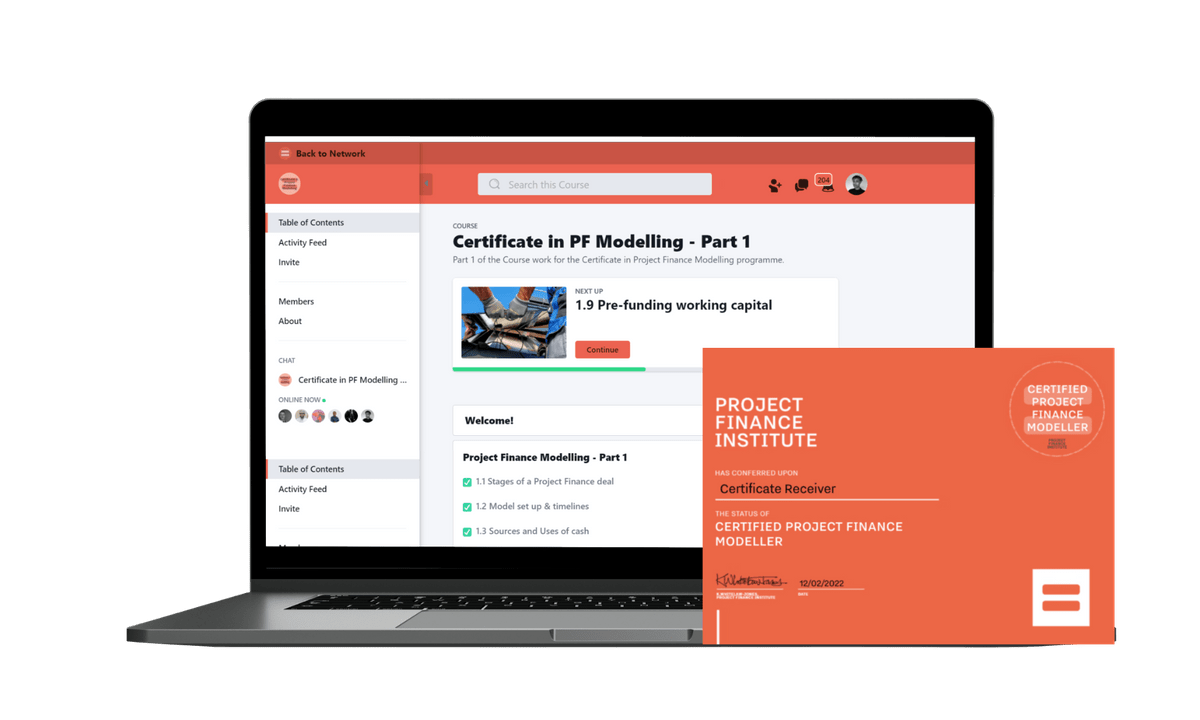

Certificate in Project Finance Modelling (CPFM)

This is the complete course in advanced Project Finance modelling.

Project Finance modelling is not just about model build skills. You also need a well-developed analytical mindset. Learn how to build a complete Project Finance model step by step.

In-depth video tutorials | Free bonus material | Live support sessions | Downloadable models |

Optional assessment to challenge your skills

THE COMPREHENSIVE PROJECT FINANCE

TRAINING COURSE

Learn real-world Project Finance techniques and put your skills to the test.

Your course includes

✓ Complete training in all aspects of Project Finance Modelling.

✓ Access to all course updates for as long as you remain a member.

✓ Weekly live online support sessions.

✓ Downloadable models and worked example files

✓ Regular live online sessions taught by our instructors.

WHAT'S INCLUDED

Our course material is delivered in a mixture of video, written, and example file format for full clarity in all areas of advanced Project Finance modelling.

-

Stages of a Project Finance deal

Model set up & timelines

Sources and Uses of cash

Construction costs

Construction financing

Financial statements

Debt sculpting & sizing

Equity returns

Pre-funding working capital

Model optimisation

Assignment: Impact of development fee on tariff

Assignment: Analysis

Shareholder loans

Debt service reserve account

CPFM Practice Case Study 1

-

How to use Excel's probability distribution functions to obtain P-values

DSCR - base case, distribution lock up & default

Average DSCR

Loan Life Cover Ratio (LLCR)

Project Life Cover Ratio (PLCR)

Average cost of debt

Weighted Average Loan Life

Debt capacity

Equity bridge loan

Multiple tranches of debt

Limitations of IRR

Mini-perm debt - Introduction

Mini-perm debt - worked example

Mini-perm debt - Renewables example

-

How to price an interest rate swap

Calculating withholding tax

Construction period balance sheet

Modelling VAT - Introduction

Modelling VAT - Part 1: Operating period VAT

Modelling VAT - Part 2: Construction Period VAT

Modelling VAT - Part 3: VAT facility

Equity payback

Tariff indexation - Introduction

Tariff indexation - worked example 1 100% indexation

Tariff indexation - worked example 2 partial indexation

Balloon repayment - intro

Balloon repayment - Part 1 - calculating level DS given a specific balloon size

Balloon repayment - Part 2 - calculating balloon size given a specific level DS

Balloon repayment - Part 3 - sculpted debt repayment with a balloon

Early generation revenue

WHO IS THIS PROGRAMME FOR?

Take the next step in your career with the Certificate in Project Finance Modelling certification.

Project Finance Analysts

PPP professionals

Infrastructure professionals

Credit Analysts

Private Equity professionals

Investment Bankers

Financial Modellers

FP&A professionals

WHAT YOU WILL LEARN

Advanced Project Finance modelling skills

1

Project analysis

2

Step-by-step Project Finance model building

3

Effective presentation for transactions

4

Get in Touch

HOW CAN WE HELP YOU?

Not sure which path is right for you or your team?

Contact our team using the form below. We are always here to discuss your Project Finance ambitions and we'll respond to you as soon as we can.